Different sectors have varying norms, and it’s essential to compare against industry averages. While a higher ratio value is generally considered to be a good thing, that doesn’t necessarily mean that firms with a lower ratio are to be avoided. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Understanding Financial Leverage

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Note that the treasury stock line item is negative as a “contra-equity” account, meaning it carries a debit balance and reduces the net amount of equity held. Considering the structure of roll-forward schedules—in which the ending balance of the current period is the beginning of period balance for the next year—the ending balances will link to the beginning balance cells. In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends.

Shareholders Equity

In contrast, a higher shareholder equity ratio shows that a higher number of assets are financed by the shareholders than borrowed money. The first step in determining a company’s equity ratio is to find information about its total equity and total assets. As an example, let’s take a look at 2018 data from Hostess (TWNK), courtesy of Nasdaq.

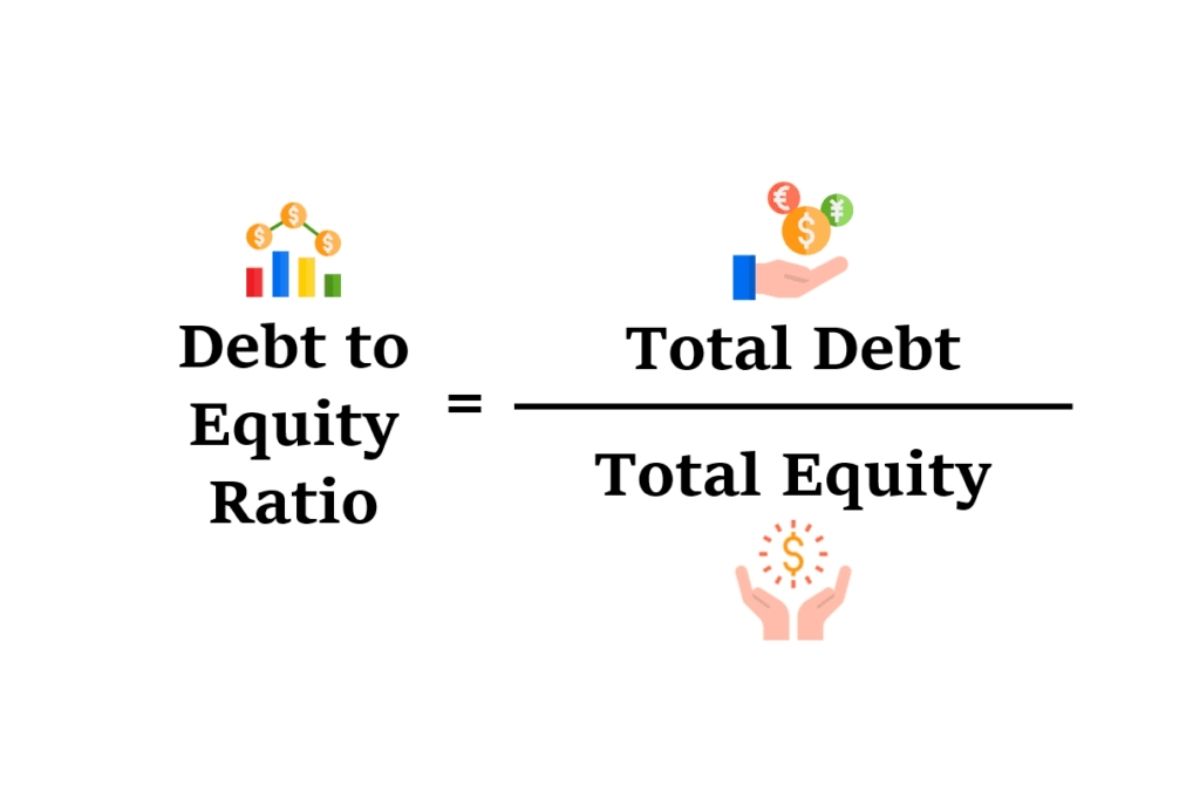

Importance of the Debt to Equity Ratio

- For example, a popular variation of the ROE ratio is to calculate the return on total equity (i.e., ordinary shares plus preferred shares).

- At the end of this, you’ll be able to calculate your business’s own equity ratio and know why it’s important to keep an eye on.

- The equity ratio is a financial metric that measures the proportion of a company’s assets financed by shareholders’ equity.

- Companies with higher equity ratios show new investors and creditors that investors believe in the company and are willing to finance it with their investments.

- In terms of sustainability, the more capable a company is of servicing its debt load over the long run, the more financially stable it is.

In diving into the nuances of how the equity ratio impacts investment decisions, it’s important to note that investors often utilize this ratio as a crucial tool for risk evaluation. However, it’s also important to note that a high equity ratio isn’t always positive – it could indicate that a company isn’t leveraging borrowed money to accelerate growth. A higher ratio value shows that a large number of shareholders consider the company to be a worthwhile investment, and it lets potential creditors know that the company is a good credit risk. When the equity ratio for a profitable company is relatively low, you’ll benefit from a higher return on investment because a smaller amount of overall equity is generating a greater level of returns. ROE calculated using the above formula is the ultimate test of a company’s profitability from the point of view of its ordinary shareholders (i.e., common stockholders). The equity of a company consists of paid-up ordinary share capital, reserves, and unappropriated profit.

Equity Ratio and Solvency

It should be equal to the sum of shareholders’ equity and the total liabilities. Tim is looking for additional financing to help grow the company, so he talks to his business partners about financing options. Tim’s total assets are reported at $150,000 and his total liabilities are $50,000. The shareholder equity ratio indicates how much of a company’s assets have been generated by issuing equity shares rather than by taking on debt.

Therefore, the equity ratio serves as a critical barometer for gauging a firm’s solvency, particularly during challenging times. Consequently, companies and investors alike should monitor this ratio closely and consider its implications on business operations. If a business has a high equity ratio, indicating lower levels of debt, it is better positioned to navigate through tough conditions. It won’t be under pressure to generate revenue merely for the purpose of servicing debt and can focus on weathering the storm. Furthermore, they can potentially capitalize on opportunities that may arise during such periods such as acquisitions or investing in new assets at a cheaper price.

If profits are increasing, then shareholders should receive more from this investment. The ratio measures the returns achieved by a company in the ins and outs of asset relation to the amount of capital invested. The higher the ROE, the better is the firm’s performance has been in comparison to its peers.

Equity Ratio calculates the proportion of total assets financed by the shareholders compared to the creditors. Generally, a higher ratio is preferred in the company as there is safety in paying debt and other liabilities. If more financing is done through equity, there is no liability for paying interest. Higher investment levels by shareholders shows potential shareholders that the company is worth investing in since so many investors are willing to finance the company. A higher ratio also shows potential creditors that the company is more sustainable and less risky to lend future loans. When a company’s shareholder equity ratio is at 100%, it means that the company has all of its assets funded with equity capital instead of debt.

Companies should regularly evaluate their ratio to ensure it aligns with their strategic goals. Investors often scrutinize the Debt to Equity ratio before making investment decisions. A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable. This implies that of every $1 employed in the business, the contribution of shareholders is about 60 cents.

Hostess’s equity ratio is 0.40 or 40%, meaning that the company has financed 40% of its assets using equity and the other 60% with debt. If a business chooses to liquidate, all of the company assets are sold and its creditors and shareholders have claims on its assets. Secured creditors have the first priority because their debts were collateralized with assets that can now be sold in order to repay them.

Leave a comment