Introduction to Accounting MCQ Quiz With Answers

However, the allocation of costs is unrelated to the R&D grant, therefore Revenue reserves the right to investigate the cost and tax treatment applied by the company. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify. Finance Strategists has an advertising relationship with some of the companies included on this website.

Learn and sharpen your accounting knowledge with accountingplay quiz app and ebook

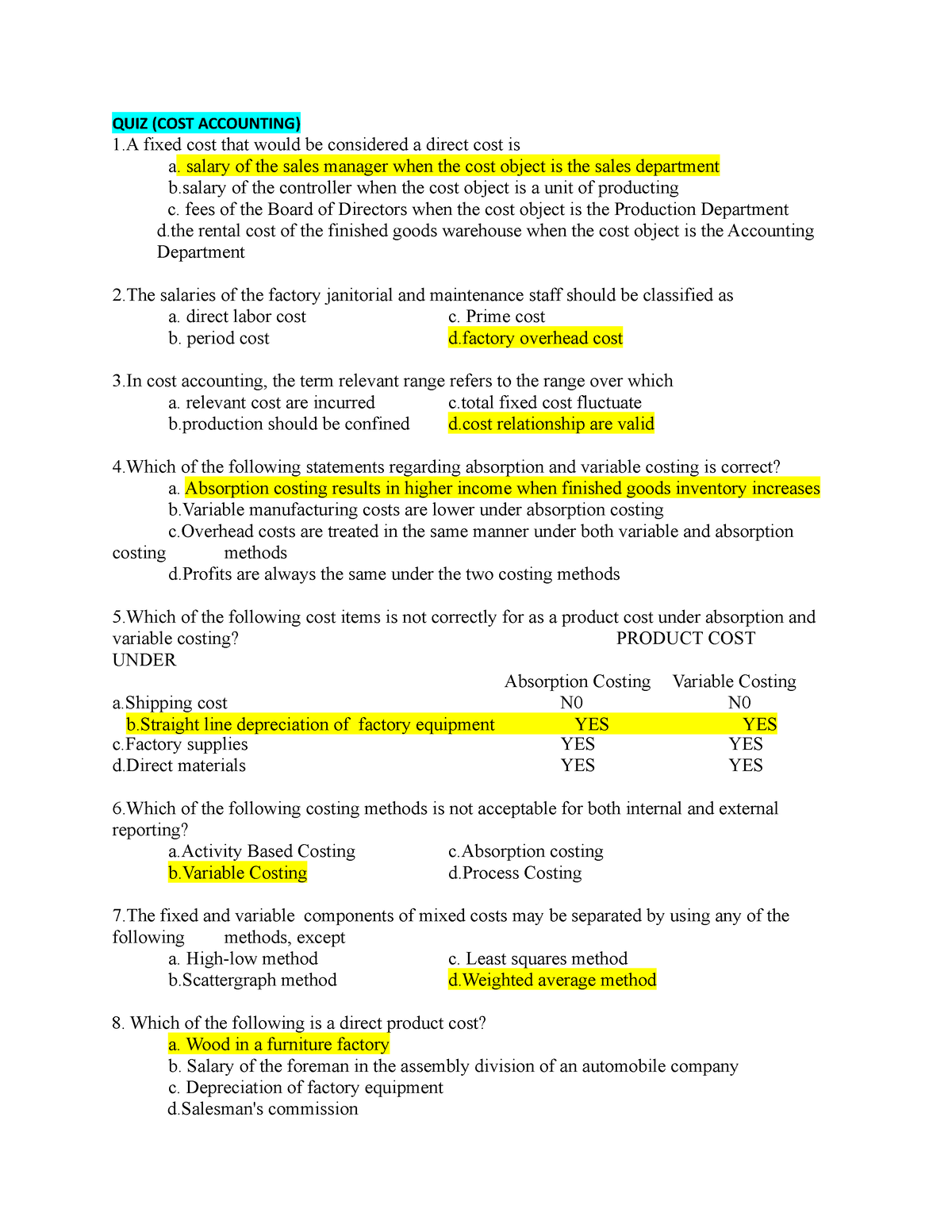

Accountants use the information to make decisions by analyzing data and trends. This information can come from Financial Statements, internal reports, surveys, and other sources. By analyzing this data, accountants can make informed decisions to help the company achieve its goals. Almost 700 unique accounting questions with PDF available inside with questions, answers, and explanations. Learn accounting and finance concepts fast and fun using contents from lessons covered in the Accounting Flashcards App. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

What are some common accounting decisions?

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. R&D tax claims can include staff wages, materials, overheads, subcontractor payments, agency staff and payments to universities and institutes of higher education. Some other costs can be included, such as royalty payments, rental costs and cloud computing costs, so long as they are incurred “wholly and exclusively” for R&D.

Latest Accounting Quizzes

It may also include a review of the methodologies in place for identifying qualifying costs and the calculations used to apportion expenditure. If we are to see more emphasis on compliance, claimants need to pre-emptively confirm that they pass both tests. Though they are officially part of Revenue’s tax day party examination into an R&D tax claim, they are a great way to confirm a project’s eligibility before making a claim. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. This multiple choice question (MCQ) test covers the topic of introduction to accounting.

Do you own a business?

Though the Accounting Test forms part of an audit from Revenue, it is important to pass this test before making your claim. You won’t know for sure until Revenue investigates your claim (which in itself is not guaranteed), but you should make your claim with the criteria in mind, so you aren’t caught out on the back end. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. If all other sites open fine, then please contact the administrator of this website with the following information. For each item below, write down what is required on a piece of paper.

If you find any questions difficult, consider reading our introduction to accounting in the explanation section of the website. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. We have experience in making claims from the micro to international scale and we know what’s needed to make a robust claim. If not, you should make an effort to see where project tracking documents can be introduced. This may include a series of questions at the commencement of any project, to determine if R&D is expected. Alternatively, you may implement monthly check-ins which review last month’s work and what new uncertainties may have arisen.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- As the R&D tax credit scheme keeps up with international equivalents in terms of legislation, we may see that Revenue increases its scrutiny of claims in line with other schemes across the globe.

With the R&D tax credit claims value surpassing the billion mark for the first time in 2022, it seems likely that Revenue will be keeping a closer eye on claimants to make sure they aren’t giving money away. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Each sector and, indeed, each company within the sector, will have different regulatory and record-keeping requirements. A pharmaceutical company will have very strict record-keeping requirements, for example. Revenue will accept records that are produced within a company’s own internal record-keeping procedures. However, it is crucial that some kind of systematic approach is implemented. As the R&D tax credit scheme keeps up with international equivalents in terms of legislation, we may see that Revenue increases its scrutiny of claims in line with other schemes across the globe.