Sales Mix: How to Calculate It For Increased Profits

The cost and profitability of each product need to be identified to find the optimal mix. Sales mix variance is a useful tool in data analysis, but alone it may not give a complete picture of why something is the way it is (root cause). Sales Mix Variance basically the changing between the budgets Sales Mix and the actual Sales Mixed at the Standard Price. transactions The concept of Sales Mix or Sales Mix Analysis has come from Sale Mix Variance. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

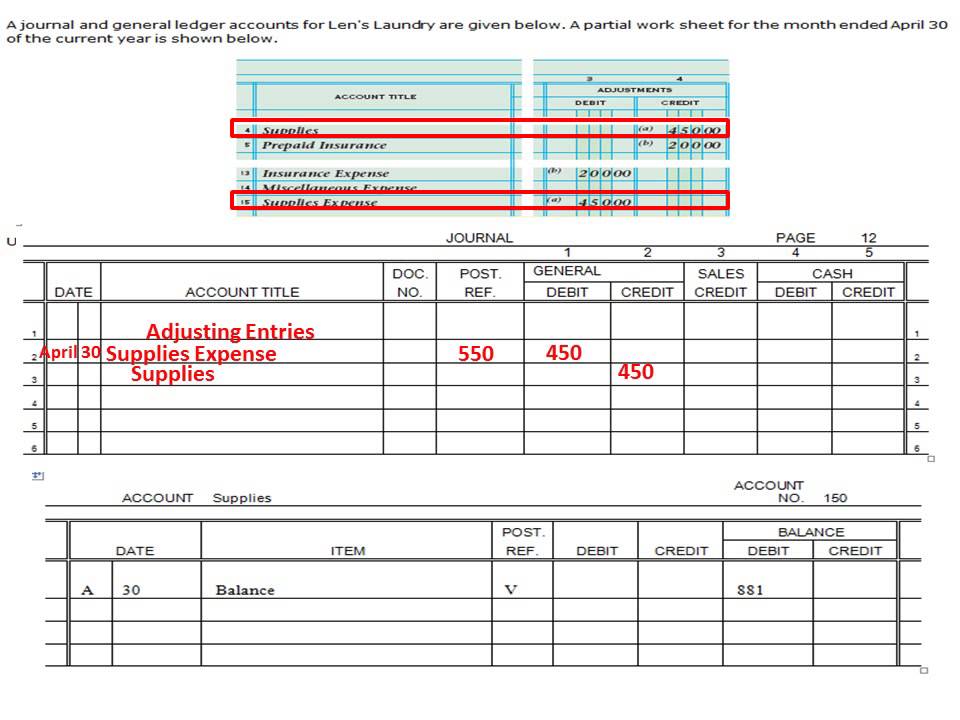

Calculation

Companies analyze the sales mix variance to ensure the sales of a product or product line are performing correctly. Analyzing the sales mix variance helps a company detect trends and consider the impact they on company profits. Calculating your sales mix helps you understand which products you need to sell more to maximize profit. Once you have those numbers, you can track your progress toward them using a customer relationship management (CRM) tool. Tracking what happened in the last period (e.g., month, quarter or custom time) allows you to compare your sales this period to see if you’re on track.

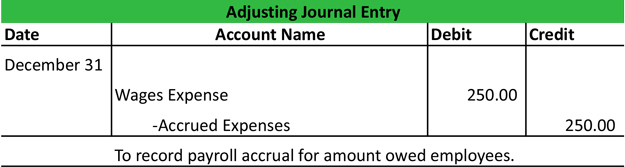

What is sales mix? Definition, formula, and best practices

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with… Technographics provide key insights to help you target the right customers. You can even customize the platform’s email templates to optimize your time to focus on higher-priority tasks, like selling on other platforms. Business owners and sales managers can use a CRM system like Pipedrive to track the number of deals on this journey. For example, you may budget to sell 50% of Product A and 50% of Product B. However, you end up selling 60% of Product A and 40% of Product B.

List of 15 Variance Analysis and Variance Formula

Planning a sales mix is a strategy decision that management must make based on economic and market conditions. For instance, a bicycle retailer might carry five $500 bicycles, two $1,000 bicycles, and one $5,000 bicycle. The company has a smaller investment in the $500 bicycles and will most likely receive a smaller profit on the sale of these bikes.

How to calculate sales mix to hit revenue goals

- The hardware store budgets for the units sold and the profit generated for each product the business sells.

- Carrying larger, more expensive products generates higher inventory costs and requires a larger cash investment.

- Most have a return that is too complex or time consuming to do themselves, but some just want the peace-of-mind knowing a tax accountant is handling it for them.

- Using this information, you may try to increase chair sales (with their higher profit potential) or explore ways to reduce variable costs for modular desks to further improve their contribution margin.

- This information helps companies understand how well their products are performing, providing valuable information about the potential profitability of their products.

Chances are, your company has budgeted sales targets for each product that you and your team are working towards. From these budgeted sales targets, your company can estimate what sales mix will be to reach your sales target. At the end of the month or quarter, you can compare the actual sales made and sales mix to what was projected. Now that you understand what sales mix is, and how to calculate it for the products your company sells, let’s discuss ways your company can make necessary improvements to sales mix to bring in more profits. When you dig into what your company’s sales mix is, you uncover hard data that tells you exactly how much money the sale of each product is contributing to the bottom line.

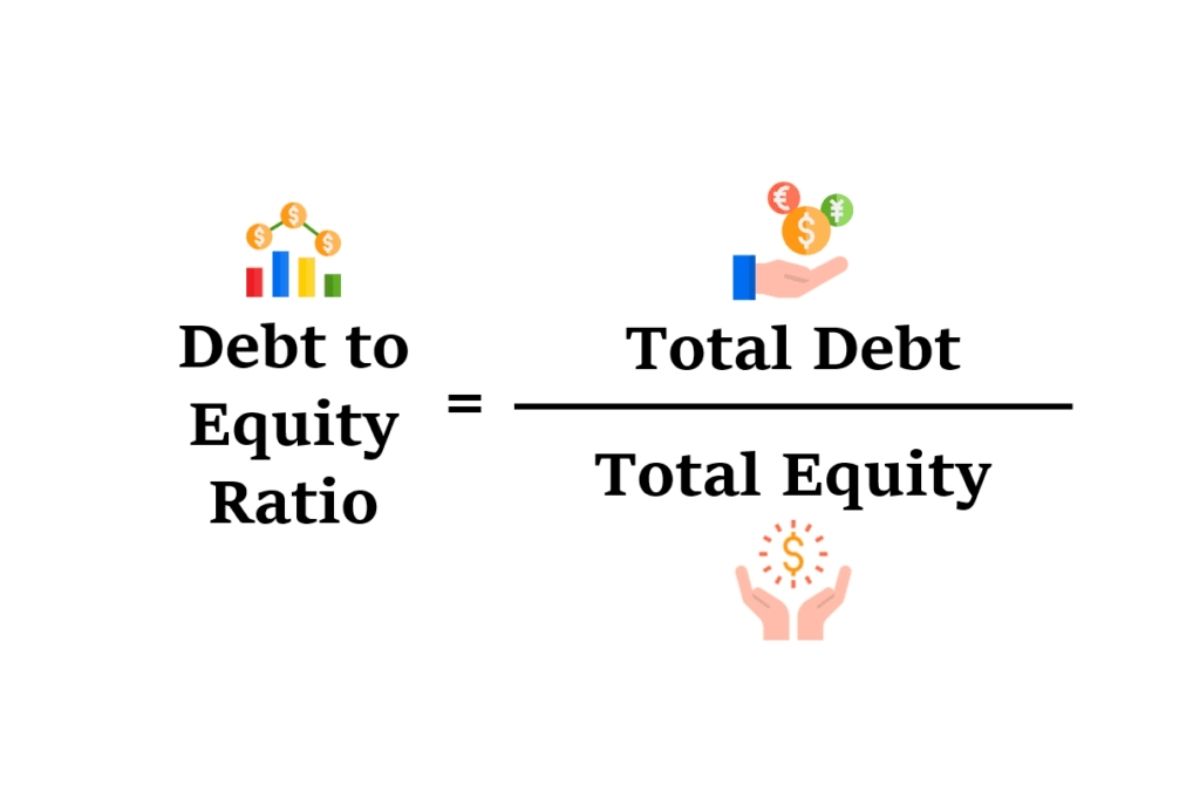

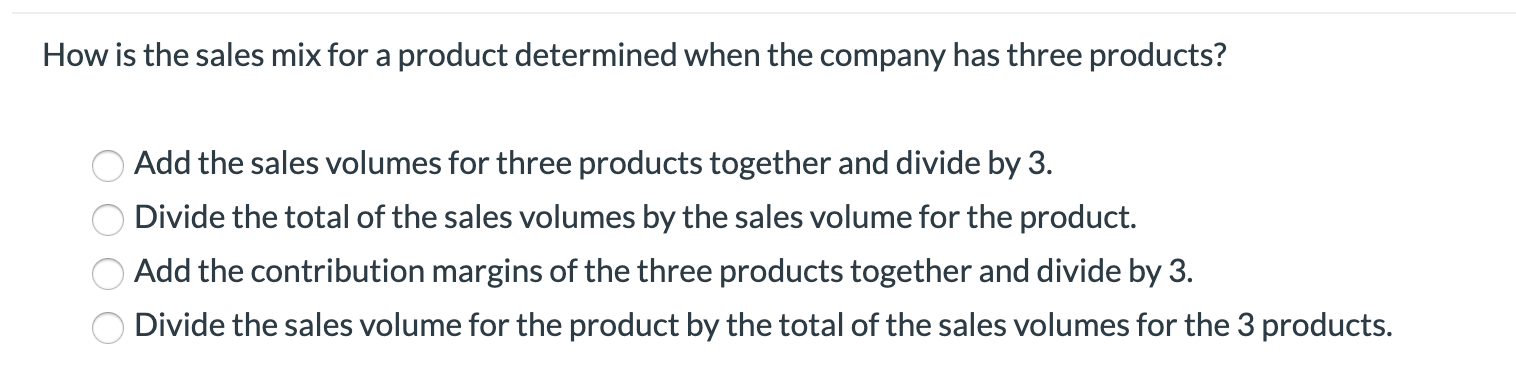

In business it’s important to understand the relationships between sales volume, costs, and profits. It is a useful technique for evaluating the potential financial impact of changes in factors such as selling price, variable costs, and fixed costs on the profitability of a business. One important concept in CVP analysis is sales mix, which refers to the proportion of different products or services a company sells. Sales mix variance is the difference between a company’s budgeted sales mix and the actual sales mix. Sales mix is the proportion of each product sold relative to total sales. Sales mix affects total company profits because some products generate higher profit margins than others.

Calculating these margins also suggests how much budget a business has to cover fixed costs (e.g., salaries) to break even or generate profit. Constant fluctuations like these make it even more crucial to assess your sales mix regularly, such as quarterly, to ensure accuracy. If you have a lot of products, you may need to calculate your sales mix monthly or even weekly. Companies use sales mix as a tool to maximize profitability and ensure they allocate resources to the right products. They sell More of the Nissan Versa because that is the low-cost car, and the demand is more for that car in the market. Therefore, the profit from the low-cost car will be less in terms of monetary value.

No matter what decision is made, a clear plan forward lets your company try a new tactic and reevaluate down the line. With a smart marketing plan, weight sets could move back into a best-seller slot. It’s all about avoiding stagnancy and moving away from decisions that are actively hurting your bottom line. You’ve finished the calculations above and have a pile of numbers in front of you—now what? It’s not worth very much unless you know how to use the results to shift sales practices and plans within the company.

From sales funnel facts to sales email figures, here are the sales statistics that will help you grow leads and close deals. As you can see, Product A broke even with a variance of 0 while Product B ended the quarter with an unfavorable variance of -$1,360.

Sales mix also has an impact on the total inventory cost incurred, and this cost may change company profit by a significant amount. If, for example, XYZ decides to stock more lawn mowers to meet spring lawn demand, the firm will earn a lower profit margin than It would if it sold hammers and other products. In addition, stocking more lawn mowers requires more warehouse space, a larger cash investment in inventory, and the expense of moving mowers into the store and out to customer vehicles.

Sales mix is the proportion of different products or services a company sells relative to each other. A company’s sales mix can impact its profitability because different products and services have different profit margins, selling prices, and demand levels. Understanding the sales mix can help companies make informed decisions about pricing, marketing, and production.