What Is Cost Per Unit: How to Calculate + Tips To Reduce in 2024

It does that by handling repetitive and labor-intensive tasks performed by human workers. Discover how to calculate and reduce unit costs for improved profitability and efficiency. It helps you inspect the areas where you can limit prices and decrease production costs for increased profit margins. For example, chemical manufacturing industries require precise formulations and processes. Standard costing may benefit them by providing a basis for estimating the costs of raw materials, labor, and overhead in chemical product manufacturing.

Pricing strategies

It is the amount of money spent in producing one unit of a product or service. CPU is not just a financial metric; it’s your guide to attaining efficiency, creating informed pricing strategies, and achieving sustainable growth. Optimizing your Cost Per Unit is key to protecting your profit margins and positioning your business strategically in the marketplace. To begin with, you can outsource non-core tasks to specialized service providers instead of handling everything in-house. It can help cut down labor costs, space requirements, warehousing expenses, and the need for special equipment.

Cost Per Unit vs. Price Per Unit

It is a crucial measure for businesses to determine their profitability and analytical capabilities. Informed businesses know how to calculate the cost per unit for each product or service offered to make informed pricing and marketing decisions. Unit cost includes all of the costs, both fixed and variable, that go into making one unit of a product or service manufactured or provided by a company.

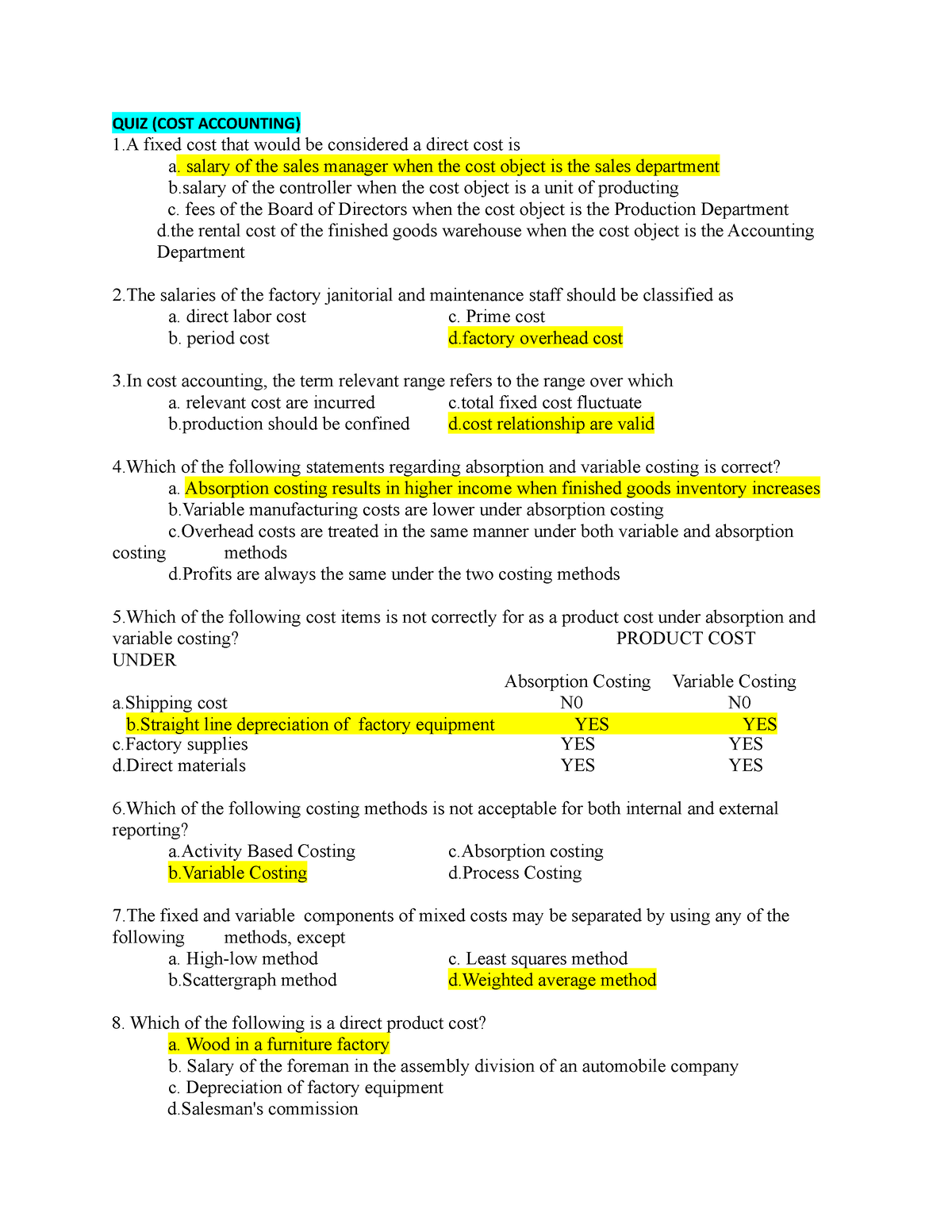

How is activity-based costing different from traditional cost accounting?

- It can be costly to fully build out this level of complex software and maintain it.

- Consider a scenario where a company manufactures 400 units of a product within a month.

- Returns can be costly for businesses, as they often involve shipping the product back to the manufacturer or retailer, inspecting it, and then reselling it or destroying it.

- However, it is crucial to consider the interplay between fixed and variable costs, as excessively high fixed costs may require a higher volume of units to break even.

- The bare costs can be used in an estimate where the estimator incorporates a separate, specific overhead estimate and actual projected profits.

If your business relies completely on variable costs, aside from discounts you may get from suppliers, your cost per unit will be the same whether you produce one unit each month or 10,000. Fixed costs are production expenses that don’t depend on the volume of units produced, such as rent, insurance, and equipment. Variable costs do depend on volume, such as salaries and the cost of purchased materials. By analyzing the cost per unit and gross margin, businesses can set the optimal selling price for each product they offer. A thorough understanding of the cost per unit can help determine how much businesses should charge for their products or services to enable efficient operations and maximize profits.

What is a Variable Cost?

The fluctuations in cost per unit are obvious to occur, and the following factors contribute to it on a larger scale. ShipBob also partners with leading inventory management solutions to increase visibility and offer more insight into demand forecasting. ShipBob’s fast-growing fulfillment network helps you save on costs when storing inventory in our fulfillment centers by only paying for the space you need. Procurement logistics and freight shipping costs also need to be evaluated to ensure finished goods are being received at the lowest costs. Additionally, a lower cost per unit can also identify gaps in internal efficiencies. Take the case of a small ecommerce business called PetsCo, which produced 100 units of an 80 lb bag of premium dog food in February 2022.

Led by Mohammad Ali (15+ years in inventory management software), the Cash Flow Inventory Content Team empowers SMBs with clear http://iznedr.ru/news/item/f00/s02/n0000205/index.shtml financial strategies. We translate complex financial concepts into clear, actionable strategies through a rigorous editorial process. By leveraging the insights and strategies outlined in this comprehensive guide, businesses can navigate the complex landscape of cost per unit analysis and drive sustainable growth. If the cost per unit is too high, your business may need to consider raising the price. Or, you might want to put in place cost-cutting measures to sustain profitability. It helps establish the minimum price required (also known as the break-even point) to cover expenses and avoid losses.

Setting the Right Selling Price

Start with regular cost audits and explore cost-saving measures like waste reduction and http://cartage.ru/board/spectekhnika_funkcionalno/dorozhnostroitelnaja_tekhnika/9111.html energy efficiency. Regular audits and reviews are always helpful in pinpointing and identifying areas where costs can be cut without compromising on quality. Rent, utility insurance, and bills, besides company size, are part of the overhead charges.

Importance of Cost per Unit Analysis

Having a process for SKU rationalization also helps you understand if a product is profitable or not. If the costs (and subsequent sales) don’t justify supporting a particular product, then it’s time to discontinue it. Any expense incurred in the storage of unsold inventory is referred to as holding costs.

Cut material costs

Unit cost is http://www.hunstory.ru/hunting/articles-about-hunting/150-exemplary-enclosures.html a vital component of arriving at a product’s market price. This result indicates that the company must sell approximately 13,334 units to break even. The breakeven analysis helps businesses set sales targets and understand the minimum sales needed to avoid losses. Typically, the price per unit exceeds the cost per unit to ensure profitability for the company. To cover costs and achieve a profit, the company needs to set a unit price higher than $21.25. In this guide, we’ll explain why understanding the cost per unit is important.