Top 50 Cryptocurrency Prices, Coin Market Cap, Price Charts And Historical Data

.jpeg)

These activities can artificially inflate or deflate the market cap of a cryptocurrency. It is important for users to be aware of these factors and conduct thorough research before making buying decisions. The total crypto market volume over the last 24 hours is $213.14B, which makes a 0.95% increase. The total volume in DeFi is currently $16.02B, 7.52% of the total crypto market 24-hour volume. The volume of all stable coins is now $190.4B, which is 89.33% of the total crypto market 24-hour volume.

- Diluted market cap takes into account all potential coins that could be in circulation, including those that may be released in the future due to factors such as mining rewards or token unlocks.

- Crypto rug pulls cause billions of dollars in loses in the global crypto markets.

- One metric that is important for comparing cryptocurrency exchanges is trading volume.

- Cryptocurrency markets are highly speculative, and market movements are often dictated by sentiment instead of fundamental factors.

- Additionally, the technology and features of a cryptocurrency can also have an impact, as innovative and unique features can attract traders and drive up market cap.

Enterprise Blockchain

Generally, altcoins attempt to improve upon the basic design of Bitcoin by introducing technology that is absent from Bitcoin. This includes privacy technologies, different distributed ledger architectures and consensus mechanisms. Cryptocurrency was invented by Satoshi Nakamoto, which is the pseudonym used by the inventor of Bitcoin.

Our crypto market overview section provides a comprehensive overview of the most important data you need to know to evaluate the current state of the cryptocurrency market. These cryptocurrencies are required to pay for transaction fees and basic operations on the blockchain. If you want to buy a particular cryptocurrency but don’t know sell my samsung galaxy beam i8520 how to do it, CoinCodex is a great resource to help you out. Find the cryptocurrency you’re looking for on CoinCodex and click the „Exchanges” tab.

Multiple Data Availability (MultiDA)

Over the past few decades, consumers have become more curious about their energy consumption and personal effects on climate change. When news stories started swirling regarding the possible negative effects of Bitcoin’s energy consumption, many became concerned about Bitcoin and robotic process automation rpa for financial services criticized this energy usage. The old blockchain will continue to exist and will continue to accept transactions, although it may be incompatible with other newer Bitcoin clients. The emergence of the first cryptocurrency has created a conceptual and technological basis that subsequently inspired the development of thousands of competing projects. Rather, it is solely a reflection of the market’s perception of a token’s worth and does not necessarily align with the fundamental value of a cryptocurrency.

.jpeg)

Properly understanding the cryptocurrency market can be complex and take time, so that is why we make it simpler by focusing on key metrics like prices, market caps, and volume. For both beginners and seasoned investors, the price action is an essential indicator of the market’s overall health and activity. By aggregating data from top exchanges, COIN360 provides a detailed snapshot of the market caps, price movements, and trading volumes of over 5000 tokens. CoinCodex provides all the data you need to stay informed about cryptocurrencies.

Conversely, negative news, security breaches, or regulatory crackdowns can all erode investor confidence, leading to a drop in prices and market cap. Central bank digital currency (CBDC) aims to take the benefits from blockchain-based digital currency and combine it with fiat currency under the control of the central bank. Bitcoin ETFs provide traditional investors with a regulated investment vehicle that enables them to invest in bitcoin without having to directly own the underlying cryptocurre… Block finality is an integral feature of blockchains, enhancing transactional security in distributed cryptocurrency networks.

Dead Coin

In May 2021, difference between a cryptocurrency broker and an exchange the Chinese government declared that all crypto-related transactions are illegal. This was followed by a heavy crackdown on Bitcoin mining operations, forcing many crypto-related businesses to flee to friendlier regions. Bitcoin is becoming more political by the day, particularly after El Salvador began accepting the currency as legal tender. The country’s president, Nayib Bukele, announced and implemented the decision almost unilaterally, dismissing criticism from his citizens, the Bank of England, the IMF, Vitalik Buterin and many others. Since the Bitcoin legal tender law was passed in September 2021, Bukele has also announced plans to build Bitcoin City, a city fully based on mining Bitcoin with geothermal energy from volcanoes. MicroStrategy has by far the largest Bitcoin portfolio held by any publicly-traded company.

You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction.

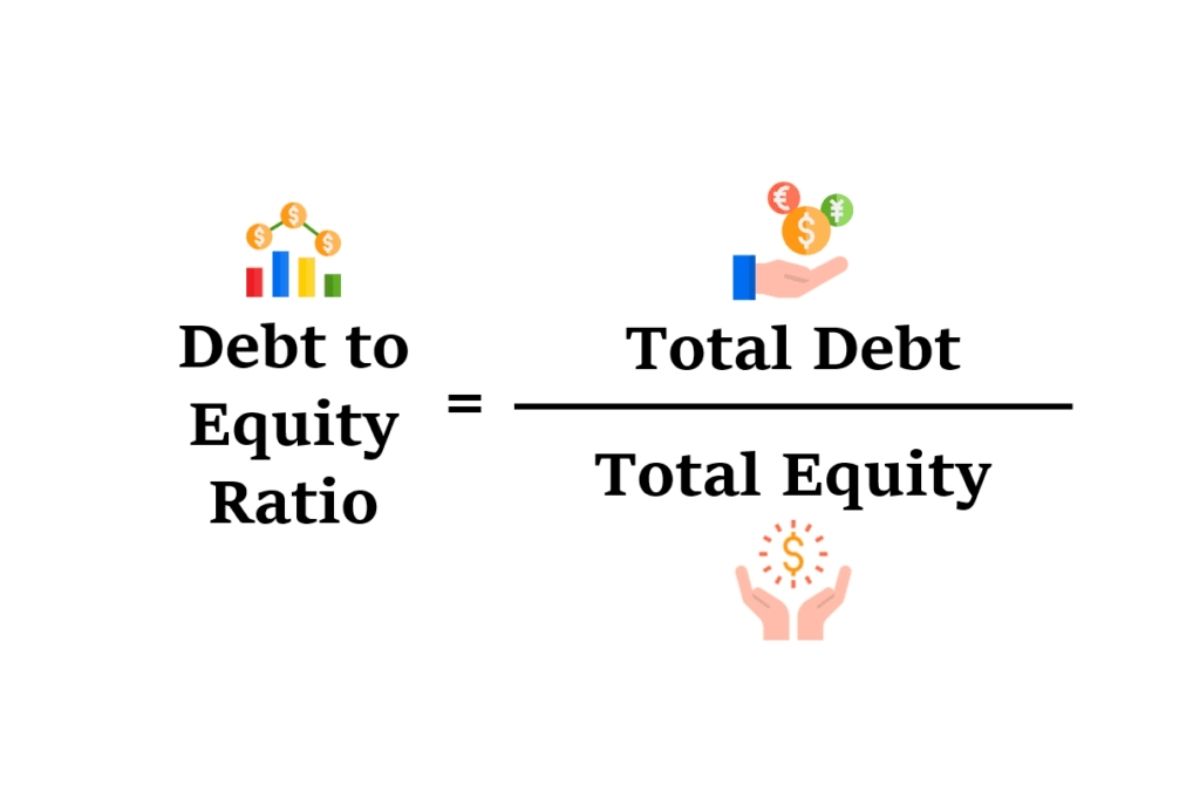

What Is Cryptocurrency Market Capitalisation?

Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world.

Bitcoin is also the most widely adopted cryptocurrency, and is accepted by practically all businesses that deal with cryptocurrency. The word „altcoin” is short for „alternative coin”, and is commonly used by cryptocurrency investors and traders to refer to all coins other than Bitcoin. Thousands of altcoins have been created so far following Bitcoin’s launch in 2009. Top cryptocurrencies such as Bitcoin and Ethereum employ a permissionless design, in which anyone can participate in the process of establishing consensus regarding the current state of the ledger. This enables a high degree of decentralization and resiliency, making it very difficult for a single entity to arbitrarily change the history of transactions.